Thursday, May 25, 2006

A Shark, Jumped

Where can you go from here? Nowhere good.

Institutional Blogs

Walker

Eye Level

Pulitzer

Eye Level

Pulitzer

On narrative

I cut my critical teeth years ago on narrative-based work and came to realize that the human mind needs narrative or narrative-like structure to help it move through time-based work. Most artists who say they are removing narrative are removing the master narrative, but they retain elements of narrative in the components they assemble to create their whole. This disjunction between narrative-driven elements and a lack of a master narrative to tie the components together almost ensures that viewers will not be able to engage fully with the work.

For time based work, need narrative to understand--even the deliberate disruption of narrative as in modernism is a form of it. But when rely on images that retain aspects of narrative but that ignores narrative things fall apart. Could, instead, create series of images--like a psycholdelic show. Move the focus toward formal aspects.

For time based work, need narrative to understand--even the deliberate disruption of narrative as in modernism is a form of it. But when rely on images that retain aspects of narrative but that ignores narrative things fall apart. Could, instead, create series of images--like a psycholdelic show. Move the focus toward formal aspects.

Monday, May 22, 2006

What I Won't be Seeing this Week

Another Monday morning, the start of another hectic week.

Whenever I can, I try to slip in a little art viewing as I travel around for work. This week is an especially flight-filled one, but it looks like I'm going to have to drive right on past all of these shows that I'm interested in seeing:

Whenever I can, I try to slip in a little art viewing as I travel around for work. This week is an especially flight-filled one, but it looks like I'm going to have to drive right on past all of these shows that I'm interested in seeing:

- Monday: Against the Grain: Contemporary Art from the Edward R. Broida Collection at MoMA

- Tuesday: Elemental at the Walker

- Wednesday: Realism and Abstraction: Six Degrees of Separation at the Nelson-Atkins

- Thursday: E.V. Day's Bride Fight back in New York at Lever House

Thursday, May 18, 2006

Lunch with the Boaters

The only thing worse than marketing the heck out of Renoir's Luncheon of the Boating Party? Recreating the darn thing lifesize, in painted bronze. (And, yes, there are more where this one came from.)

Wednesday, May 17, 2006

News around New York

Carol Vogel gets busy for the Times today with two pieces of note.

Dia's Chairman, Leonard Riggio, is resigning his post--and perhaps leaving the board. With no director, no board chair, no vice chair, no Manhattan home, a projected operating deficit for next year (an operating deficit even after closing its Manhattan locations?!?), and a capital campaign underway that needs to raise up to $40M, Dia is facing some serious challenges. Serious challenges. Dia has always relied on the largesse of a single patron. Here's to hoping another one emerges quickly.

On a more positive note, Tishman Speyer and the Public Art Fund have announced this fall's selection for the now annual Rockefeller Center commission: Anish Kapoor. I'm really hoping that his giant curved mirror won't be reflecting sunlight off the building across the street and into my office window. I'm not sure that my life insurance policy covers being burned to death by reflected sunlight.

Dia's Chairman, Leonard Riggio, is resigning his post--and perhaps leaving the board. With no director, no board chair, no vice chair, no Manhattan home, a projected operating deficit for next year (an operating deficit even after closing its Manhattan locations?!?), and a capital campaign underway that needs to raise up to $40M, Dia is facing some serious challenges. Serious challenges. Dia has always relied on the largesse of a single patron. Here's to hoping another one emerges quickly.

On a more positive note, Tishman Speyer and the Public Art Fund have announced this fall's selection for the now annual Rockefeller Center commission: Anish Kapoor. I'm really hoping that his giant curved mirror won't be reflecting sunlight off the building across the street and into my office window. I'm not sure that my life insurance policy covers being burned to death by reflected sunlight.

Why Art Isn’t a Great Long Term Investment: A Case Study, Part 2 of 2

The Joan Mitchell painting I have been writing about could be used to illustrate the opinion of many managing art investments today. Art, they claim, is an alternate investment class that keeps pace with or outperforms the market.

Most of these claims are backed up with reference to the Mei/Moses Fine Art Index, an index of the art market’s performance developed and maintained by two professors at NYU’s Stern School of Business. The index calculates the performance of the art market by comparing prices of works sold more than once on the secondary market over the last century.

The problem with this methodology is that it only looks at the winners. The major auction houses, the source of the data used to calculate the index, do not typically take work by artists who don’t have an established reputation. The index also does not account for work that goes on the block but does not sell.

The Joan Mitchell painting with its return of 11.9% CAGR is the sort of art market winner that serves as the basis for the Mei/Moses Index. The piece was bought early at a low price, was held for a period of time over which it appreciated significantly, and was sold at auction for a substantial profit. (This piece won’t, though, go into the index unless it is sold at auction a second time.)

That painting was purchased for very little money when Mitchell was a young, emerging artist and didn’t have the reputation she has now. What are the odds that a purchase like this is going to provide the return that this painting did? Probably very small: one or two times out of ten—if the collector has a great eye and is lucky.

I started this series of posts by referring to Dorothy Miller’s collection, and that’s where I’ll end. Miller had one of the best eyes for the art of her age of anyone collecting at the middle of the last century. She wasn’t, I’m sure, collecting as an investment. She bought early and held pieces for her whole life. Only after she passed away was her collection sold.

The collection contained small works by big name artists, and she definitely had her share of financial winners: Jasper Johns, Franz Kline, Alexander Calder, and Lee Bontecou, among others. But Miller also had pieces by other artists who have been forgotten by art history.

There was one piece in her collection that caught my eye and my imagination back in the fall of 2003 when the work was shown at Christie’s. It was a small ab ex painting, about the same size as the Mitchell piece, and it was every bit as good. The painting was by an artist about whom I had never heard. I did some digging at the time and discovered that he was a painter who had lived in New England for most of his life and had never developed more than a local reputation as an artist. All I could find about him was an obituary in a small town newspaper.

The piece was estimated, I believe, to sell for less than $1000. It ended up selling for slightly more than that. Assuming that Miller bought the piece in the mid-1950s for around $125, the painting as an investment barely kept pace with inflation and under-performed the stock market.

But what a little jewel of a painting it was.

Even MoMA curator Dorothy Miller, with her great eye and access to work by artists whose reputation she had a hand in making, was not able to consistently pick investment quality art for her personal collection. But she did consistently pick great art that she must have loved living with.

That’s what collecting ought to be about—picking pieces because you love them, and living with them over the long haul. About the best you can do is claim that art is a venture capital-type investment. A few pieces, if you know how to pick them, may provide outsized returns. Many more may mirror the market. The majority, though, will barely keep pace with inflation—if even that.

Most of these claims are backed up with reference to the Mei/Moses Fine Art Index, an index of the art market’s performance developed and maintained by two professors at NYU’s Stern School of Business. The index calculates the performance of the art market by comparing prices of works sold more than once on the secondary market over the last century.

The problem with this methodology is that it only looks at the winners. The major auction houses, the source of the data used to calculate the index, do not typically take work by artists who don’t have an established reputation. The index also does not account for work that goes on the block but does not sell.

The Joan Mitchell painting with its return of 11.9% CAGR is the sort of art market winner that serves as the basis for the Mei/Moses Index. The piece was bought early at a low price, was held for a period of time over which it appreciated significantly, and was sold at auction for a substantial profit. (This piece won’t, though, go into the index unless it is sold at auction a second time.)

That painting was purchased for very little money when Mitchell was a young, emerging artist and didn’t have the reputation she has now. What are the odds that a purchase like this is going to provide the return that this painting did? Probably very small: one or two times out of ten—if the collector has a great eye and is lucky.

I started this series of posts by referring to Dorothy Miller’s collection, and that’s where I’ll end. Miller had one of the best eyes for the art of her age of anyone collecting at the middle of the last century. She wasn’t, I’m sure, collecting as an investment. She bought early and held pieces for her whole life. Only after she passed away was her collection sold.

The collection contained small works by big name artists, and she definitely had her share of financial winners: Jasper Johns, Franz Kline, Alexander Calder, and Lee Bontecou, among others. But Miller also had pieces by other artists who have been forgotten by art history.

There was one piece in her collection that caught my eye and my imagination back in the fall of 2003 when the work was shown at Christie’s. It was a small ab ex painting, about the same size as the Mitchell piece, and it was every bit as good. The painting was by an artist about whom I had never heard. I did some digging at the time and discovered that he was a painter who had lived in New England for most of his life and had never developed more than a local reputation as an artist. All I could find about him was an obituary in a small town newspaper.

The piece was estimated, I believe, to sell for less than $1000. It ended up selling for slightly more than that. Assuming that Miller bought the piece in the mid-1950s for around $125, the painting as an investment barely kept pace with inflation and under-performed the stock market.

But what a little jewel of a painting it was.

Even MoMA curator Dorothy Miller, with her great eye and access to work by artists whose reputation she had a hand in making, was not able to consistently pick investment quality art for her personal collection. But she did consistently pick great art that she must have loved living with.

That’s what collecting ought to be about—picking pieces because you love them, and living with them over the long haul. About the best you can do is claim that art is a venture capital-type investment. A few pieces, if you know how to pick them, may provide outsized returns. Many more may mirror the market. The majority, though, will barely keep pace with inflation—if even that.

Friday, May 12, 2006

Why Art Isn’t a Great Long Term Investment: A Case Study, Part 1 of 2

Almost every new collector asks the question at least once. “Is this piece of art I’m considering going to increase in value?” And almost any decent art advisor or dealer is going to answer in the same way. “It might. But don’t buy art as an investment. Buy it because you love it.”

The financial performance of the small Joan Mitchell painting (at right) that I mentioned in my last post provides an interesting case in point. The piece sold for $51,000 (including buyer’s premium) this week—just about at the mid-point of its presale estimate.

The financial performance of the small Joan Mitchell painting (at right) that I mentioned in my last post provides an interesting case in point. The piece sold for $51,000 (including buyer’s premium) this week—just about at the mid-point of its presale estimate.

I wanted to determine how well the painting did as an investment for its owner, and I started with the Inflation Calculator. It told me that $125 in 1955 dollars (the year the owner bought the piece from Mitchell’s gallery) is the equivalent of $859 in 2005 dollars. So this lucky early supporter of Mitchell’s work beat inflation (which averaged 3.9% per year over that period) significantly with his or her investment. By how much, though?

To figure that out, I calculated the compound annual growth rate (CAGR) of the investment. Of the $51,000 purchase price, the seller took home a bit over $38,600 after the buyer’s premium and seller’s fee were subtracted. That means that this investment appreciated on average 11.9% per year over the period that the owner held the painting.

(As an interesting aside, the work was put up for sale at Christie’s in the fall of 1997 with a pre-sale estimate of $30,000-$35,000. It didn’t sell. If it would have gone at the mid-point of its estimate, it would have returned 13.4% CAGR—a much better return than it realized this week, even though Mitchell’s market is significantly more active now than it was then. Christie’s, it seemed, seriously overestimated the work’s value nine years ago.)

Over the time period that the owner held this painting, the Dow Jones Industrial Average has posted a CAGR of 6.3% and the S&P500 has shown a CAGR of 6.7%. Since its inception in 1971, the NASDAQ has performed better (9.4% CAGR) but still not as well as this Mitchell piece. (These index returns do not account for the reinvestment of dividends which really should be included to make this an apples-to-apples comparison. I would be happy to update the post if any financial types can provide me with the data to rerun the numbers.)

While the painting has outperformed these benchmark indices, it hasn’t shown a truly stupendous return. Well managed hedge funds will return 15-20% CAGR over a lengthy period. While the return on this little Joan Mitchell painting has been about as good (on a pure percentage basis) as could possibly be, when time is taken into consideration by looking at CAGR the return isn’t amazing. It did beat the market by a wide margin, but a smart asset manager can do significantly better.

Related: CAGR analyses of the secondary art market seem to be in the air this week.

Next: what this painting (and a similar one) tell us about recent theories of art as a viable investment vehicle.

The financial performance of the small Joan Mitchell painting (at right) that I mentioned in my last post provides an interesting case in point. The piece sold for $51,000 (including buyer’s premium) this week—just about at the mid-point of its presale estimate.

The financial performance of the small Joan Mitchell painting (at right) that I mentioned in my last post provides an interesting case in point. The piece sold for $51,000 (including buyer’s premium) this week—just about at the mid-point of its presale estimate.I wanted to determine how well the painting did as an investment for its owner, and I started with the Inflation Calculator. It told me that $125 in 1955 dollars (the year the owner bought the piece from Mitchell’s gallery) is the equivalent of $859 in 2005 dollars. So this lucky early supporter of Mitchell’s work beat inflation (which averaged 3.9% per year over that period) significantly with his or her investment. By how much, though?

To figure that out, I calculated the compound annual growth rate (CAGR) of the investment. Of the $51,000 purchase price, the seller took home a bit over $38,600 after the buyer’s premium and seller’s fee were subtracted. That means that this investment appreciated on average 11.9% per year over the period that the owner held the painting.

(As an interesting aside, the work was put up for sale at Christie’s in the fall of 1997 with a pre-sale estimate of $30,000-$35,000. It didn’t sell. If it would have gone at the mid-point of its estimate, it would have returned 13.4% CAGR—a much better return than it realized this week, even though Mitchell’s market is significantly more active now than it was then. Christie’s, it seemed, seriously overestimated the work’s value nine years ago.)

Over the time period that the owner held this painting, the Dow Jones Industrial Average has posted a CAGR of 6.3% and the S&P500 has shown a CAGR of 6.7%. Since its inception in 1971, the NASDAQ has performed better (9.4% CAGR) but still not as well as this Mitchell piece. (These index returns do not account for the reinvestment of dividends which really should be included to make this an apples-to-apples comparison. I would be happy to update the post if any financial types can provide me with the data to rerun the numbers.)

While the painting has outperformed these benchmark indices, it hasn’t shown a truly stupendous return. Well managed hedge funds will return 15-20% CAGR over a lengthy period. While the return on this little Joan Mitchell painting has been about as good (on a pure percentage basis) as could possibly be, when time is taken into consideration by looking at CAGR the return isn’t amazing. It did beat the market by a wide margin, but a smart asset manager can do significantly better.

Related: CAGR analyses of the secondary art market seem to be in the air this week.

Next: what this painting (and a similar one) tell us about recent theories of art as a viable investment vehicle.

Tuesday, May 09, 2006

Fantasy Shopping for a Joan Mitchell

Every auction season I go fantasy shopping—looking for things that I would love to own but that are far beyond my reach. I typically look for strong examples of favorite artists’ work that is scaled to my small New York apartment. It’s harder than you might imagine to find pieces that fit this bill. The Judd I mentioned recently is one example.

Another example is the Lee Bontecou wall relief that Christie’s sold in the fall of 2003 (right). The piece was part of MoMA curator Dorothy Miller’s personal collection, and it had hung in her New York apartment for years. Several works, actually, in Miller’s collection meet my criteria. She had what I think was a perfect Franz Kline—just big enough to give a sense for the majesty of his grand paintings, but small enough to fit comfortably in a living room with eight-foot ceilings.

Another example is the Lee Bontecou wall relief that Christie’s sold in the fall of 2003 (right). The piece was part of MoMA curator Dorothy Miller’s personal collection, and it had hung in her New York apartment for years. Several works, actually, in Miller’s collection meet my criteria. She had what I think was a perfect Franz Kline—just big enough to give a sense for the majesty of his grand paintings, but small enough to fit comfortably in a living room with eight-foot ceilings.

Since her traveling retrospective a few years ago, Joan Mitchell’s work is coming up for auction more frequently than it used to. Mitchell’s small work doesn’t usually fit the criteria I have for a great apartment piece because Mitchell didn’t always scale her work down very well. (Not many artists who work large do it well, actually.) Most of the small Mitchell paintings that I have seen feel different than her large canvases because she used the same sized brushes on the diminutive work that she used on her more sizable paintings. As a result, the relationship between the individual brushstroke and the whole canvas has a completely different feel in the small pieces than it does in the large.

I haven’t liked most of the small Mitchell work that has come to market in recent seasons, but Sotheby’s has an early piece of hers going on the block this week that is just about perfect (at right). For this 19 x 16 inch canvas, Mitchell sized down her brushstrokes to retain the same scale relationship to the canvas that her larger paintings have. It’s that adjustment that makes the piece work so well. It doesn’t just feel like Joan Mitchell working on a small canvas. It feels like a small Joan Mitchell canvas.

I haven’t liked most of the small Mitchell work that has come to market in recent seasons, but Sotheby’s has an early piece of hers going on the block this week that is just about perfect (at right). For this 19 x 16 inch canvas, Mitchell sized down her brushstrokes to retain the same scale relationship to the canvas that her larger paintings have. It’s that adjustment that makes the piece work so well. It doesn’t just feel like Joan Mitchell working on a small canvas. It feels like a small Joan Mitchell canvas.

I was intrigued enough by the piece to ask one of Sotheby’s art handlers to show me the back of the canvas at the preview last weekend because I was surprised that Sotheby’s was listing the year of execution as 1953. The piece appeared to me to be in a style that Mitchell didn’t really perfect until a few years later. I wondered if there were any markings on the inverse side that would confirm or deny my suspicious.

When I got a peek at the back (below left), I immediately saw what I was looking for—what appears to be an original label from the Stable Gallery confirming that the piece was painted in 1953 (below right). I also noted that the gallery label listed the original asking price for the work: $125. My immediate thought was that with a current auction estimate of $40,000-$60,000 someone had done very well with that investment.

When I returned home after the preview, I decided to figure out just how well the piece had actually performed for its single owner over the last 50-odd years. I was surprised by what I found when I ran some numbers.

Next: why art isn't a great long term investment, even when it appreciates significantly.

Another example is the Lee Bontecou wall relief that Christie’s sold in the fall of 2003 (right). The piece was part of MoMA curator Dorothy Miller’s personal collection, and it had hung in her New York apartment for years. Several works, actually, in Miller’s collection meet my criteria. She had what I think was a perfect Franz Kline—just big enough to give a sense for the majesty of his grand paintings, but small enough to fit comfortably in a living room with eight-foot ceilings.

Another example is the Lee Bontecou wall relief that Christie’s sold in the fall of 2003 (right). The piece was part of MoMA curator Dorothy Miller’s personal collection, and it had hung in her New York apartment for years. Several works, actually, in Miller’s collection meet my criteria. She had what I think was a perfect Franz Kline—just big enough to give a sense for the majesty of his grand paintings, but small enough to fit comfortably in a living room with eight-foot ceilings.Since her traveling retrospective a few years ago, Joan Mitchell’s work is coming up for auction more frequently than it used to. Mitchell’s small work doesn’t usually fit the criteria I have for a great apartment piece because Mitchell didn’t always scale her work down very well. (Not many artists who work large do it well, actually.) Most of the small Mitchell paintings that I have seen feel different than her large canvases because she used the same sized brushes on the diminutive work that she used on her more sizable paintings. As a result, the relationship between the individual brushstroke and the whole canvas has a completely different feel in the small pieces than it does in the large.

I haven’t liked most of the small Mitchell work that has come to market in recent seasons, but Sotheby’s has an early piece of hers going on the block this week that is just about perfect (at right). For this 19 x 16 inch canvas, Mitchell sized down her brushstrokes to retain the same scale relationship to the canvas that her larger paintings have. It’s that adjustment that makes the piece work so well. It doesn’t just feel like Joan Mitchell working on a small canvas. It feels like a small Joan Mitchell canvas.

I haven’t liked most of the small Mitchell work that has come to market in recent seasons, but Sotheby’s has an early piece of hers going on the block this week that is just about perfect (at right). For this 19 x 16 inch canvas, Mitchell sized down her brushstrokes to retain the same scale relationship to the canvas that her larger paintings have. It’s that adjustment that makes the piece work so well. It doesn’t just feel like Joan Mitchell working on a small canvas. It feels like a small Joan Mitchell canvas.I was intrigued enough by the piece to ask one of Sotheby’s art handlers to show me the back of the canvas at the preview last weekend because I was surprised that Sotheby’s was listing the year of execution as 1953. The piece appeared to me to be in a style that Mitchell didn’t really perfect until a few years later. I wondered if there were any markings on the inverse side that would confirm or deny my suspicious.

When I got a peek at the back (below left), I immediately saw what I was looking for—what appears to be an original label from the Stable Gallery confirming that the piece was painted in 1953 (below right). I also noted that the gallery label listed the original asking price for the work: $125. My immediate thought was that with a current auction estimate of $40,000-$60,000 someone had done very well with that investment.

When I returned home after the preview, I decided to figure out just how well the piece had actually performed for its single owner over the last 50-odd years. I was surprised by what I found when I ran some numbers.

Next: why art isn't a great long term investment, even when it appreciates significantly.

Thursday, May 04, 2006

Excuses, Excuses

This could be the longest I have ever gone without posting anything to the blog. But I’ve been busy. Real busy.

So here’s what I’ve been up to. I lead two lives. I write about one-half of them here. If you’re curious about the other half, read this. (And, yes, I was there and watched him eat a heaping plate full of pig’s snout. Even tried some myself. I’ll say only this: one snout was enough for me.) The thing is, that representation is really only a quarter of my life of late, not a half. The other quarter has been spent in the Caribbean—and not in the way that you’re thinking. Hotel, office, airplane; hotel, office, airplane. No sun, no fun, no glamour.

Yeah, yeah. Excuses, excuses. I know. How about some good stuff?

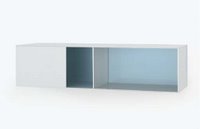

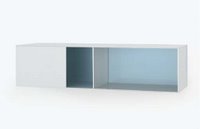

I managed to squeeze in two workdays this week back in New York. Today over lunch I stopped by the Judd preview at Christie’s for what will probably be my final visit--and for what's probably my last chance to see the most perfect apartment-sized Judd piece ever (at right). I still can’t get over the pristine condition of the work on display. The thing about pieces by Judd is that even though they don’t look it, they are so, so, so fragile. One little fingerprint, and the work is seriously scarred.

I managed to squeeze in two workdays this week back in New York. Today over lunch I stopped by the Judd preview at Christie’s for what will probably be my final visit--and for what's probably my last chance to see the most perfect apartment-sized Judd piece ever (at right). I still can’t get over the pristine condition of the work on display. The thing about pieces by Judd is that even though they don’t look it, they are so, so, so fragile. One little fingerprint, and the work is seriously scarred.

A few of the pieces on display at Christie’s have picked up a stray fingerprint or two in the last month, but on the whole the work is remarkably clean. The last time I visited, MoMA had four Judd pieces up in the hallway to the cafeteria. The difference in condition between those pieces and the pristine pieces at Christie’s is immediately noticeable. If you haven’t seen the show yet, by all means make a point of seeing it this weekend before the work gets dispersed to various private collections strewn between the Upper East Side and Greenwich, CT.

I was also home last weekend and managed to sneak in a couple hours in Chelsea. I decided to do a north-to-south gallery crawl and didn’t make it any farther than 26th Street before I ran out of time and energy. There’s a lot worth seeing right now. Here’s a list of my current picks:

So here’s what I’ve been up to. I lead two lives. I write about one-half of them here. If you’re curious about the other half, read this. (And, yes, I was there and watched him eat a heaping plate full of pig’s snout. Even tried some myself. I’ll say only this: one snout was enough for me.) The thing is, that representation is really only a quarter of my life of late, not a half. The other quarter has been spent in the Caribbean—and not in the way that you’re thinking. Hotel, office, airplane; hotel, office, airplane. No sun, no fun, no glamour.

Yeah, yeah. Excuses, excuses. I know. How about some good stuff?

I managed to squeeze in two workdays this week back in New York. Today over lunch I stopped by the Judd preview at Christie’s for what will probably be my final visit--and for what's probably my last chance to see the most perfect apartment-sized Judd piece ever (at right). I still can’t get over the pristine condition of the work on display. The thing about pieces by Judd is that even though they don’t look it, they are so, so, so fragile. One little fingerprint, and the work is seriously scarred.

I managed to squeeze in two workdays this week back in New York. Today over lunch I stopped by the Judd preview at Christie’s for what will probably be my final visit--and for what's probably my last chance to see the most perfect apartment-sized Judd piece ever (at right). I still can’t get over the pristine condition of the work on display. The thing about pieces by Judd is that even though they don’t look it, they are so, so, so fragile. One little fingerprint, and the work is seriously scarred.A few of the pieces on display at Christie’s have picked up a stray fingerprint or two in the last month, but on the whole the work is remarkably clean. The last time I visited, MoMA had four Judd pieces up in the hallway to the cafeteria. The difference in condition between those pieces and the pristine pieces at Christie’s is immediately noticeable. If you haven’t seen the show yet, by all means make a point of seeing it this weekend before the work gets dispersed to various private collections strewn between the Upper East Side and Greenwich, CT.

I was also home last weekend and managed to sneak in a couple hours in Chelsea. I decided to do a north-to-south gallery crawl and didn’t make it any farther than 26th Street before I ran out of time and energy. There’s a lot worth seeing right now. Here’s a list of my current picks:

- Joseph Marioni at Peter Blum Chelsea

- Helen Verhoeven at Wallspace

- Tracy Nakayama at ATM

- David Rathman at Clementine

- Joe Fig at Plus Ultra